by Mike Lewis | Nov 26, 2025

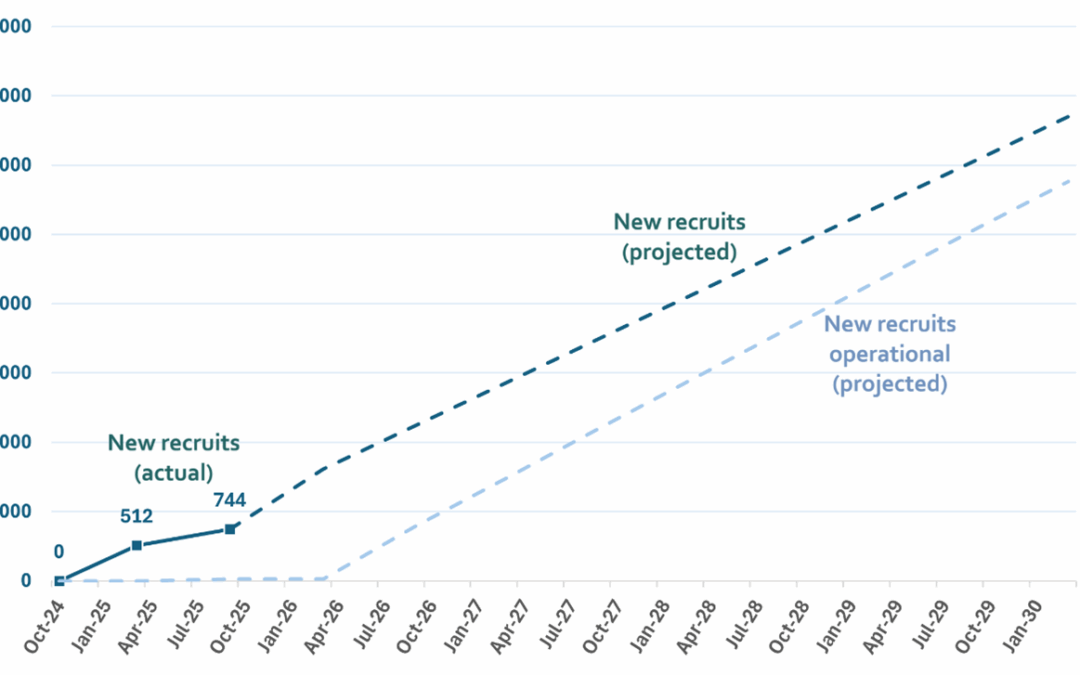

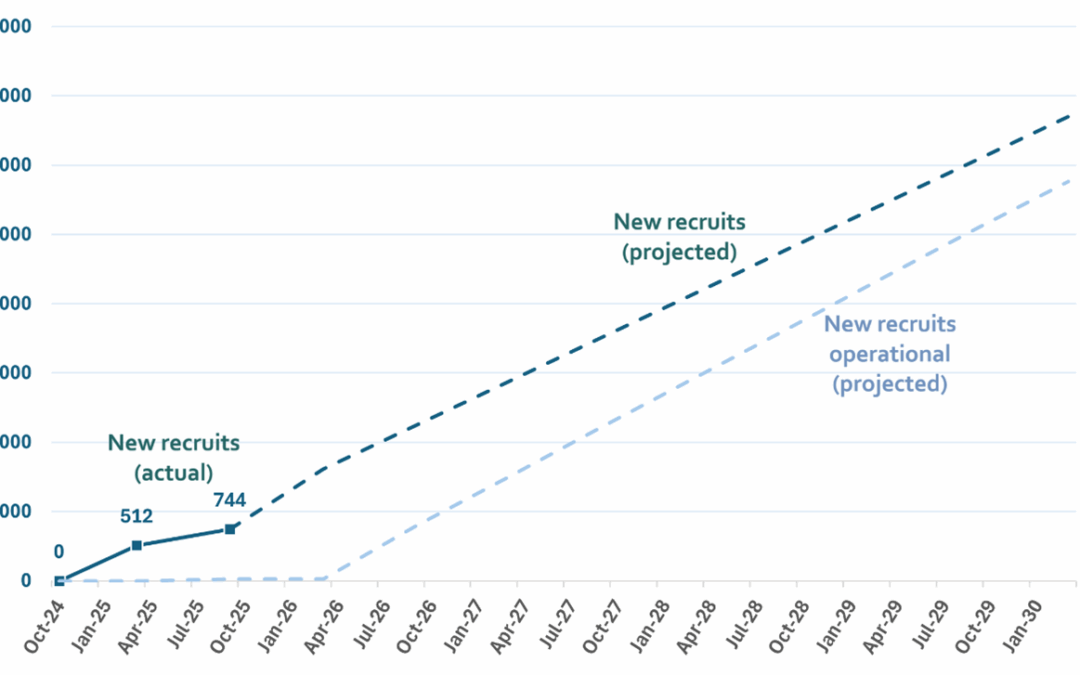

Budget’s third-largest tax pledge relies on UK tax authority that is suffering from recruitment delays and unfinished IT systems Just 26 of 6,700 extra compliance/debt staff promised by Chancellor are so far in post Decision to retain tax on digital...

by Mike Lewis | Nov 19, 2025

What is Rachel Reeves’ second-biggest revenue-raising policy so far? As well as being a question for the most niche pub quiz ever, It’s something that would be near-impossible to guess from the public debate in the run up to this year’s Autumn...

by Mike Lewis | Nov 15, 2025

Estimating the impact of exempting US-headed groups from Pillar 2 taxes Full report On 28 June 2025, the UK Chancellor and other finance ministers from the G7 group of countries (Canada, France, Germany, Italy, Japan, the UK and the US) unilaterally announced that in...

by Mike Lewis | Nov 5, 2025

Read full analysis A tax deal for US multinationals backed by Chancellor Rachel Reeves could potentially hand US companies a $40 billion annual tax break next year, including around $6 billion for US tech giants, according to new analysis from TaxWatch. The UK...

by Mike Lewis | Oct 6, 2025

Read full report Executive Summary The Patent Box is a UK tax relief which allows companies to pay a corporation tax rate of 10% on profits related to the exploitation of patented inventions and products, rather than the usual 25% rate. Introduced in 2013, the Patent...

by Mike Lewis | Aug 29, 2025

The UK is in a fiscal tight spot. The Chancellor has promised to raise an additional £7.5 billion over the next four years by boosting HMRC compliance efforts. The Autumn Budget is likely to see more measures intended to make this number go up: perhaps extra...