-

New analysis shows that the number of users of disguised remuneration schemes has increased dramatically despite government attempts to legislate against the schemes

-

Criminal investigations against promoters remain a rarity, with no successful prosecutions being brought against disguised remuneration promoters

On 30 November, HMRC published its latest update on the use of marketed tax avoidance schemes, including disguised remuneration schemes. 1Corporate Report, Use of marketed tax avoidance schemes in the UK (2019 to 2020), HM Revenue & Customs, 30 November 2021, … Continue reading

HMRC state in their update that it “is determined to do all it can to stop unscrupulous promoters”, and that they are “targeting those who promote these schemes using all of HMRC’s powers.”

On that basis, something appears to be going seriously wrong.

According to the latest figures, the use of disguised remuneration schemes, which is one form of mass marketed scheme, remains significantly higher than before the loan charge was announced in 2016.

In 2013-2014 HMRC estimated that there were 22,000 individuals and 6,000 employers involved in mass marketed tax avoidance schemes. That peaked in 2017-18 at 41,000 individuals and 3,000 employers. In 2019-20, the latest year HMRC have figures for, the numbers are 28,000 individuals and 1,000 employers, a decline from 33,000 individuals and 2,000 employees in the previous year.

Figure 1: Number of individuals and employers using avoidance schemes each year, source: HMRC

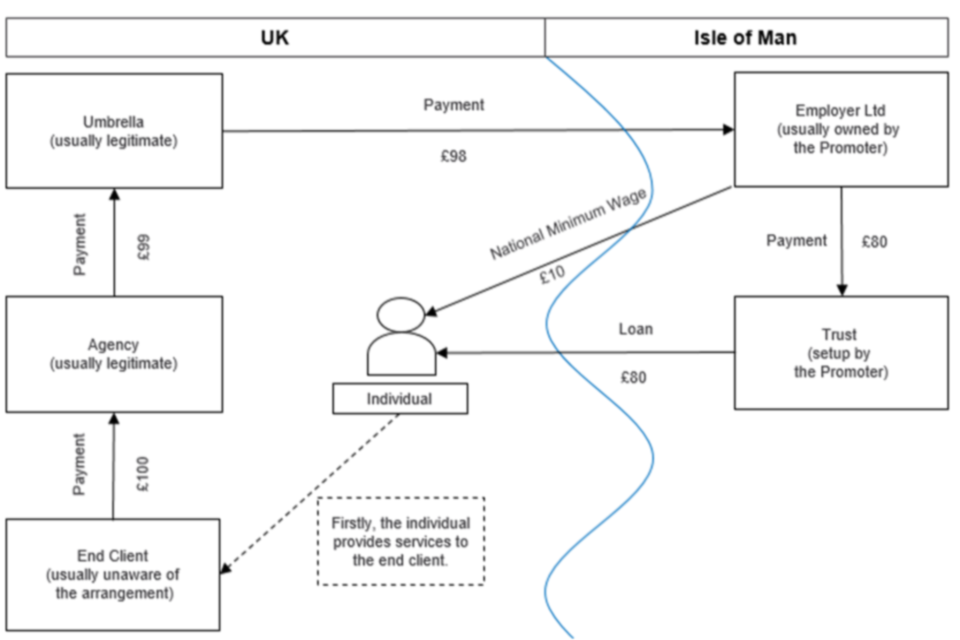

These figures relate to all mass marketed schemes, however, HMRC report that composition of the market for these schemes has changed markedly. In 2013-14, 35% of schemes were sideways loss relief schemes, and 60% were disguised remuneration schemes. In 2019-20 HMRC state that 100% of schemes on the market are classified as disguised remuneration.

A sideways loss relief scheme involves the creation of an investment which is structured to make paper losses which are then used to offset against an individual’s income tax return. It is a type of tax avoidance that was popular with high net worth individuals.

Figure 2: Use of avoidance scheme by type, source:HMRC

If we adjust the figures for the total number of individuals using marketed schemes to take into account the changing nature of the market as published by HMRC, we calculate that in 2013-14, there were 13,200 people on disguised remuneration schemes, rising to 32,670 in 2018-19 and 28,000 in 2019-20. That is an increase of 110% between 2013-14 and 2019-20.

We put these figures to HMRC, who responded: “The tax avoidance market continues to be dominated by disguised remuneration avoidance schemes, often targeted at contractors and agency workers. Between 13/14 and 19/20 we have seen a large increase in the numbers of avoidance uses from Disguised Remuneration schemes.

During 2019 to 2020 we made over 500 interventions into promoters and enablers of tax avoidance across a range of different taxes and reporting obligations. This includes interventions into non-compliant umbrella companies operating avoidance schemes.” 2Correspondence received via email from HMRC on 06 December 2021

The 2016 Budget speech 3Budget 2016: George Osborne’s speech, Gov.uk, 16 March 2016 https://www.gov.uk/government/speeches/budget-2016-george-osbornes-speech when the loan charge was first revealed it was claimed that the policy would “shut down disguised remuneration schemes”. On that measure, the policy has been a failure.

In their latest data, HMRC state that there are still between 20-30 organisations behind most tax avoidance schemes marketed to the public. That is no change on when HMRC last reported the figures in the previous year.4Corporate Report, Use of marketed tax avoidance schemes in the UK (2018 to 2019), HM Revenue & Customs, 30 November 2021, … Continue reading HMRC state “Since the last report was published some promoter organisations have left or significantly reduced their activity in the avoidance market. However, new promoters have entered the market.”

Furthermore, in relation to disguised remuneration schemes HMRC’s latest report discloses that there are between 60-80 non-compliant umbrella companies involved in their operation.

The use of umbrella companies to propagate disguised remuneration schemes means that data on who uses the schemes is not accurate. The largest group of users of such schemes according to HMRC are those involved in “book keeping activities”, which is what a user would be classed as if they were part of an umbrella company, regardless of what their actual trade may be. This is important because it demonstrates that HMRC are not aware of which professions are being targetted by scheme promoters. This is particularly concerning as there has been a significant amount of controversy over HMRC’s action to recover funds from employees on lower incomes.

Clearly, the surest way to close down a promoter of a tax avoidance scheme is to put them in jail. Curiously, the role of HMRC’s powers of criminal investigation appear to have been downplayed in this year’s report. In 2020, HMRC stated: “Whenever HMRC identifies a promoter or enabler of avoidance schemes we will always consider whether there is scope for a criminal prosecution. Promoting tax avoidance is not, on its own, a criminal offence but we will investigate with a view to prosecution where there is evidence that a promoter or enabler has committed fraud whilst designing or marketing avoidance schemes.”

The 2021 edition of the report has the following passage: “As well as our full range of civil sanctions, where an avoidance scheme involves fraud or other criminal offences, HMRC uses the full range of criminal powers to tackle those who promote or enable avoidance schemes.” HMRC then adds, “Since April 2016, more than 20 individuals have been convicted for offences relating to fraudulent arrangements promoted and marketed as tax avoidance schemes. The courts ordered over 100 years of custodial sentences. Most of these individuals were promoters.”

In 2020 TaxWatch sent in an FoI request asking how many criminal investigations had been opened and how many convictions HMRC had secured with regard to the promoters of disguised remuneration schemes specifically.

The answer was that over the previous five years, the department had opened nine investigations with none of them having led to a conviction at the time of the request. It is therefore important to be clear that where HMRC say they have convicted more than 20 individuals since 2016, they are not referring to promoters of disguised remuneration schemes.

We asked HMRC for an update on the numbers, and they could not provide one. We can therefore only assume that there is yet to be a single successful criminal prosecution for a promoter of a disguised remuneration scheme.

Most likely the people that have been convicted are those promoting other forms of schemes, such as sideways loss relief schemes. For example, in 2019 HMRC secured the conviction of Banyard and Blakey for a scheme involving fraudulent investments in a cure for HIV.5Two jailed for £60m fraudulent HIV cure tax fraud, HM Revenue and Customs, 25 February 2019, … Continue reading Terrence Potter (who was already in jail for organising another tax fraud) and others, were convicted in 2017 for their involvement in a film scheme 6IFA and ex-police officer jailed over film tax scam, FT Adviser, 05 June 2018 https://www.ftadviser.com/your-industry/2018/06/05/ifa-and-ex-police-officer-jailed-over-film-tax-scam/

The way in which HMRC combine their reporting on action related to sideways loss relief schemes, with action on disguised remuneration is becoming a bit of a theme.

In a recent Public Accounts Committee Hearing, Sara Olney, MP for Richmond Park asked, “just quickly on the loan charge what is the progress that has been made on pursuing the promoters of schemes?” 7Public Accounts Committee Hearing on HMRC Annual Accounts 2020-21, Parliamentlive, 01 December 2021, https://parliamentlive.tv/event/index/d41af347-292b-4dcd-a87b-caca502ee109?in=14:03:31

The reply from Jim Harra stated, “The situation with the promotion of tax avoidance is over recent years, we feel we’ve been very successful at driving the respectable end of the tax profession out of offering tax avoidance, so the large accountancy firms, the banks, the main law firms all now have a code of practice that prevents them from doing that, but what we are left with is a core of about 20-30 hard core promoters.” He then went onto detail how the structure of the market had changed as a result of this, with most schemes now being targeted at employment income rather than high net worth individuals.

What Mr Harra is clearly referencing here is the shutting down of the sideways loss relief schemes. The latest HMRC data shows that these schemes have almost disappeared. However, this type of tax avoidance was always very different from disguised remuneration.

Sideways loss schemes were targeted at high net worth individuals (hence the involvement of major accountancy firms) and often used external financing arrangements to create fictitious losses that were used to write off a high earner’s tax bill (hence the involvement of large banks).

Disguised remuneration schemes, which is what Mrs Olney’s question was directed at, was always a different market, operated by different firms and targeting different groups of people. The figures demonstrate that there has been little progress in tackling these schemes over the last ten years, and it is not correct to suggest that the success in closing down a different from of tax avoidance should be used as a benchmark to assess the department’s performance in confronting the promoters of disguised remuneration schemes.

HMRC are clearly banking on being able to do more after they receive new powers to shut down promoters being considered as part of the current Finance Bill. However, there should be a continued focus on how the criminal law that already exists could be applied to the promoters of schemes.

HMRC’s description of what has been told to taxpayers by the promoters of schemes, which includes “You are told the schemes are safe, compliant or approved by HMRC. This is not true, HMRC does not approve avoidance schemes”, very clearly constitutes a misleading or false statement designed to prejudice the revenue, and therefore could fall under the criminal offence of cheating the public revenue.

HMRC have in the past claimed that the promoters being located offshore makes prosecution difficult. However, as we have pointed out, and as confirmed by Jim Harra in response to a question from Peter Grant at the Public Accounts Committee, there is no impediment for HMRC to arrest promoters located in the Crown Dependencies – That being the case, what are they waiting for?

References